What Gives Bitcoin Value?

Subscribe for free so you don't miss our next article!

You might be wondering...

In this article, we'll answer all those questions and more!

One of the most common criticisms of Bitcoin is that it "has no intrinsic value".

But what does that really mean, and is it true?

Value can be defined as "the regard that something is held to deserve; the importance, worth, or usefulness of something". However, this definition leads to more questions:

Who is it, exactly, that gets to make these decisions about value? This definition does not say.

Generally speaking, there are two types of value:

For something to have "intrinsic value", it is said to be valuable in and of itself. In other words, this kind of value requires no decision-maker. It speaks for itself and is immediately known to have value by anyone who encounters it, just by virtue of the way it is. For example, if someone asks you "why is it good to help the poor?" you might say "because it's good for their needs to be met". But if someone asks "why is it good that their needs are met?" you might be puzzled, because it seems like it just is. There is no obvious deeper reason. Your intuition is that helping the poor is intrinsically valuable; it requires no further explanation. Similarly, if someone asks "why is it good to feel happiness?" you may struggle to find any reasons beyond "it just is".

In contrast, something that has "extrinsic value" is said to be valuable because of what it enables, offers, or affords to someone or something. For example, a chair is valuable because it affords a person the ability to sit down comfortably and rest. Similarly, a share of stock is valuable because it gives its holder a promise of ownership in a company that produces goods or services and generates cash flow. However, if human beings ceased to exist tomorrow, it would be difficult to argue that either a chair or a share of stock has value anymore. Therefore, these items do not seem to be valuable in and of themselves.

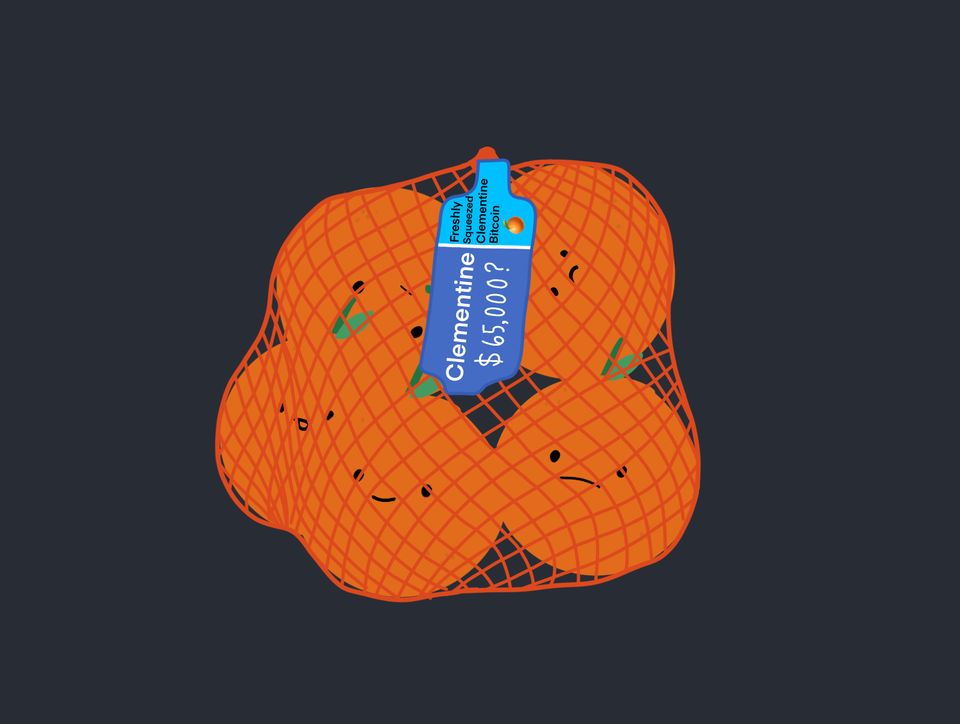

The best way to organically discover whether something has intrinsic value is to talk to any 3-year-old. When presented with a statement or explanation, these little philosophers will always ask an important follow-up question: why?

At some point in this line of questioning, you will no longer be able to answer your miniature interrogator because you will have reached bedrock––that value which has no further dependencies, is not derivative of anything, and which serves no external purpose. This is intrinsic value.

By now, it should seem obvious that the answer is "no, it does not"; at least, not by the definition proposed above. However, neither does gold, silver, bonds, stocks, paper money, guns, jewelry, or for that matter, food and water. None of these items appear to have value in and of themselves. Rather, they have extrinsic value: they are valuable because of what they enable, offer, or afford to someone or something. Food and water are valuable because they enable many types of living things, including humans, to continue living. Jewelry is valuable because it pleasurable to look at, brings confidence to those that wear it, and displays status.

Thankfully, the market price of an item is not (and will never be) based on the value it has in and of itself; otherwise, practically every asset class in the market would hopelessly collapse as worthless.

Bitcoin, as is the case with these other assets, is valuable because of what it offers. It is valuable because of what people can do with it, not because of what it is in and of itself. Therefore, Bitcoin has extrinsic value. Some might even argue its value is practically infinite in these terms.

Let's find out why.

This is the first thing people think of when they hear "bitcoin" mentioned in conversation. The reason for this is simple: every four years, bitcoin's price climbs higher by several multiples, shattering expectations and generating massive "FOMO" (Fear Of Missing Out) among onlookers. This makes news headlines, many existing holders get "rich" in fiat terms, and a new wave of people notice bitcoin for the first time because they see an opportunity to make money. These newcomers devote hours, days, and months to learning about it and begin to recognize how revolutionary it is. Eventually, these people participate in Bitcoin not to make money, but for everything else. This fuels the next cycle, and so on.

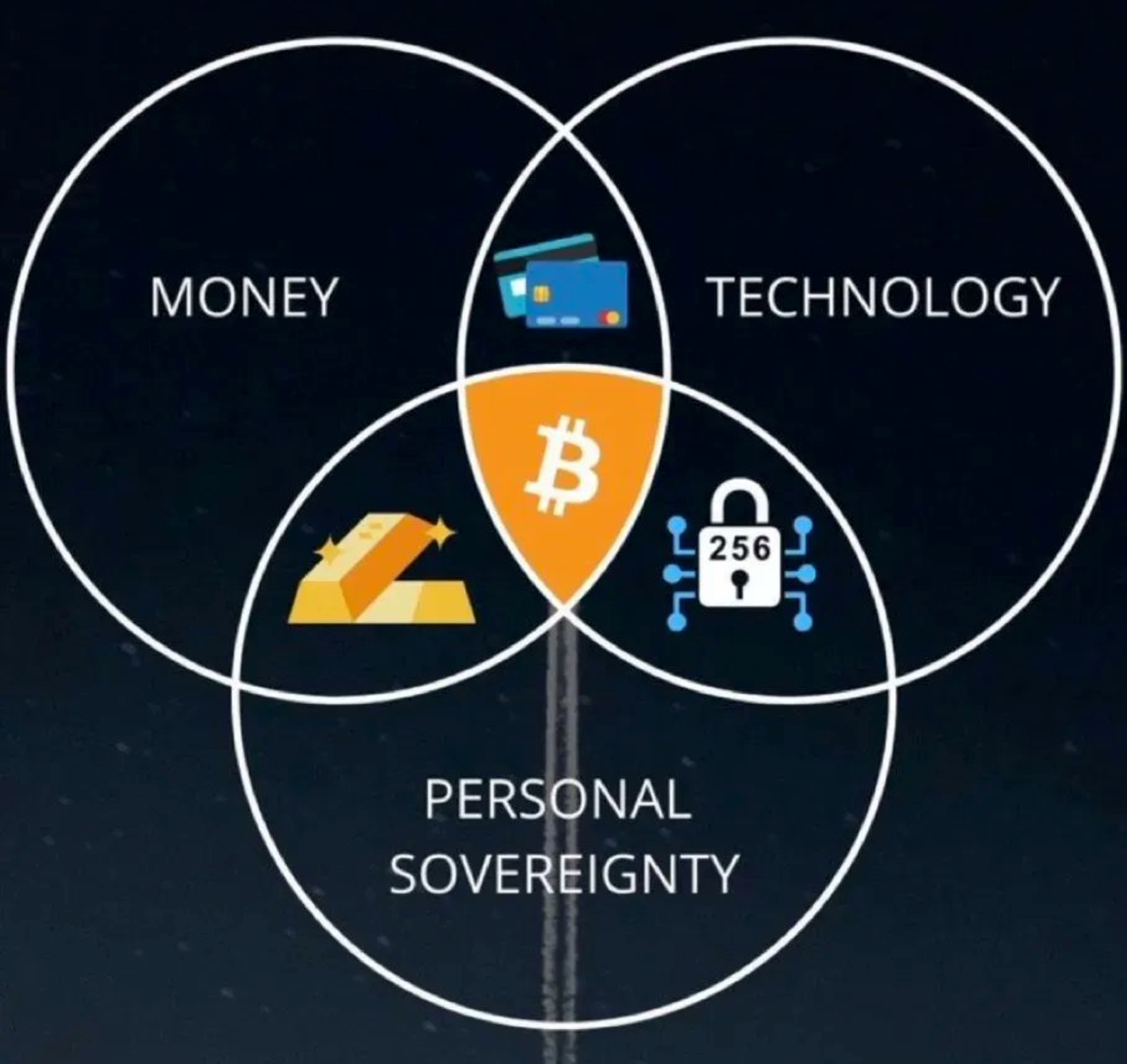

As discussed in our first article What Is Bitcoin?, the powerful monetary characteristics of bitcoin make it the soundest money in the world. It is scarce, fungible, durable, divisible, and portable. Within each monetary category, bitcoin far exceeds its peers such as prior commodity and fiat monies or other cryptocurrencies. It is decentralized, its fundamental monetary properties are unalterable, and its ledger is the most secure, immutable record ever created for any purpose by mankind. This is because every aspect of bitcoin is transparent and easily verifiable to anyone, yet all of it is backed by the most powerful network of computing power in the world.

What sets bitcoin apart from other forms of sound money like gold and silver is that it is compatible with 21st century technology. For much of human history, gold and silver did a fantastic job fulfilling the monetary needs of civilizations. They store value reliably well and they are highly durable. However, in the 20th century, technological advancements in various industries accelerated commerce and stretched it beyond domestic borders, creating a fast-paced global economy. The growth and speed of commerce around the world demanded the ability to communicate value quickly and efficiently, in both small and large quantities. This was not easy to achieve with heavy, clunky minerals like gold and silver.

Instead, the world transitioned toward paper claims on gold to facilitate faster commerce. As discussed in our prior article, after only a couple decades those paper bills no longer claimed any gold because demand quickly overwhelmed gold reserves. Thus, technology––or rather the lack thereof––is partly what led to gold being supplanted by fiat systems.

Bitcoin fixes this. Where gold failed––namely in its difficulty to transport and poor divisibility per unit value––bitcoin is succeeding. While retaining and improving upon the monetary aspects of gold that make it a sound money and a reliable store of value, bitcoin is also purely digital and can be transported around the globe at the speed of light, in any quantity and for little to no fees.

Now, in a world where advancements in computers and microchips have reduced most physical appliances from a typical 20th century person's office space to digital equivalents crammed into an all-knowing rectangle you keep in your pocket, the same has finally happened to money itself. We now have money (bitcoin) that can move across the rails of the Internet just as fast as we can send texts. You may think this already existed without bitcoin in the form of Venmo, your credit card, or some other app or service. However, not only do those services not let you use bearer instruments meaning you don't truly own the value you hold on those networks, they aren't even claims on bearer instruments. Instead, the digital fiat you use on those networks are just promises backed by promises backed by more promises, eventually backed by trust in the government.

Unlike Visa and PayPal, which are apps and services that communicate fiat promises, bitcoin is a tool for human rights built upon free, open source, permission-less software and backed with electricity. It offers everyone on the planet the purest form of property ownership ever imagined: the world's most secure "bank account", comprised of nothing but encrypted information, which can be kept on paper in one's pocket, memorized, or secured in innumerable customized ways, and which is denominated in a currency whose supply cannot be manipulated.

OK, that was a mouthful.

To put it more succinctly: Bitcoin has de-materialized sound money, banks, and financial middlemen. Instead of entrusting those responsibilities with wealthy corporations and corrupt political institutions, bitcoin lets you carry out all those functions by yourself, for free. You don't need anyone's permission. Nobody can stop you.

To illustrate this: hold out your hand in front of your face and look at it. You have complete autonomy and discretion over that hand. This is called personal sovereignty. You own that hand, and only you can decide what happens to it.

Thanks to bitcoin, we now live in a world where that same level of ownership, control, and discretion you have over your own hand is available to you for your money. In fact, ownership of bitcoin is arguably much more secure because it's pure information, which makes it easy to hide safely. Conversely, your hand is a physical object in space that can become damaged, worn out over time, or even attacked by others.

Bitcoin is the purest form of property ownership that exists on the planet today.

That is why it has a very, very high degree of extrinsic value.

If Bitcoin is technology, won't a better cryptocurrency just replace it someday?

In short: No.

Let's talk about why!

"Altcoin" is short for "alternative coin", which refers to any cryptocurrency besides bitcoin. Given that bitcoin was the first successful cryptocurrency (launched in 2009 by an unknown person or group who went by the pseudonym "Satoshi Nakamoto"), all other cryptocurrencies are alternative coins.

The biggest misconception in the crypto world (and the reason thousands of altcoin scams exist) is the idea that because bitcoin was the first successful cryptocurrency, it is therefore "old" technology and will be replaced by something faster, more efficient, or less energy-intensive. This is a fallacy, because it assumes various goals of bitcoin's main blockchain that do not actually exist and fails to recognize the importance of layered scaling. Unfortunately, due to poor regulation and education, venture capitalists, celebrities, and special interest groups often take advantage of this fallacy by launching their own altcoins and selling these scams to people who think they can get rich on "the next bitcoin".

To get a better idea of just how many of these worthless altcoin scams have been peddled over the past decade, check out this list of "dead" coins. As of 7/3/2022, there are at least 1,706 dead cryptocurrencies.

In reality, the next bitcoin is... bitcoin.

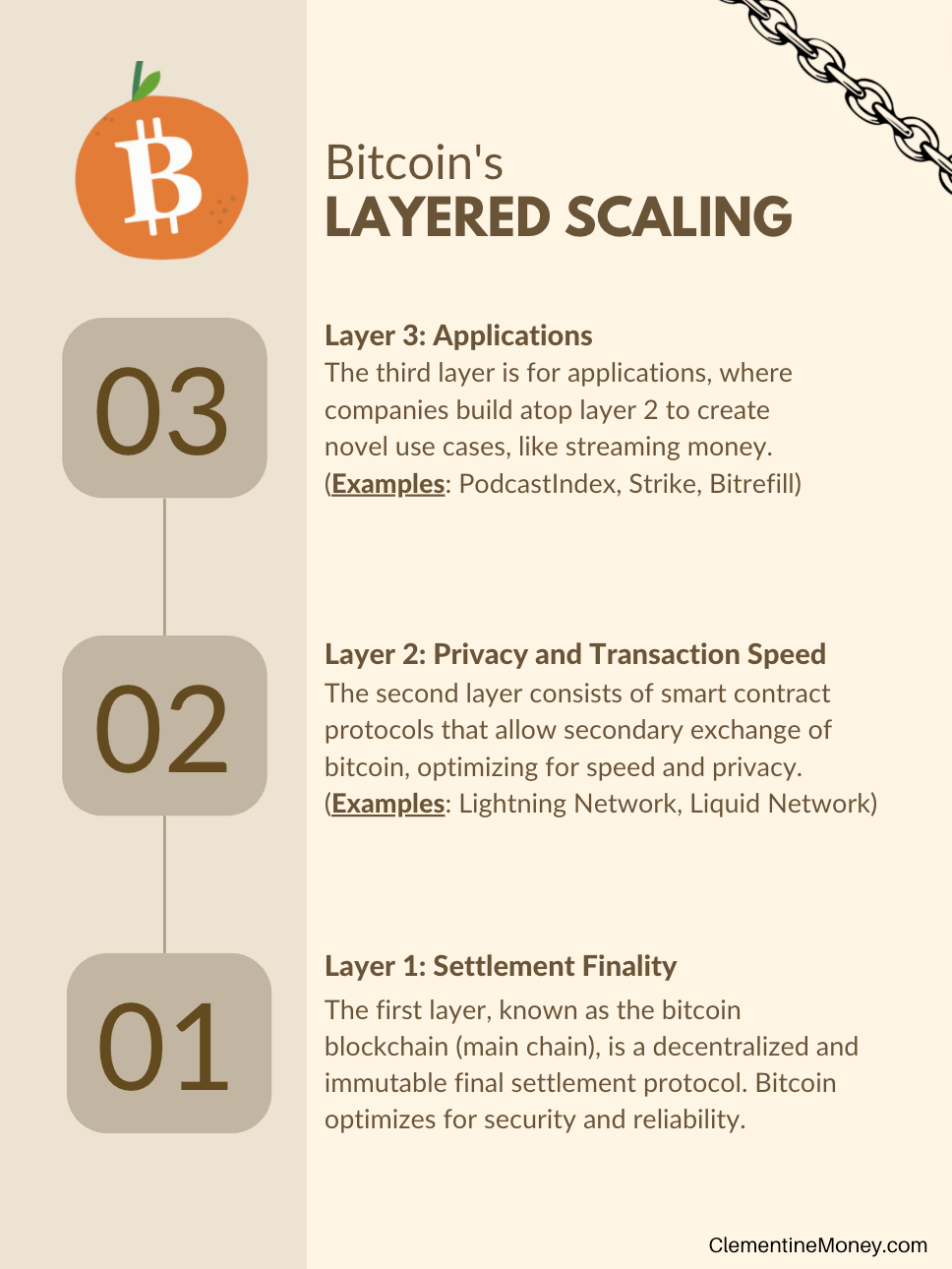

Bitcoin is gradually scaling toward widespread global adoption through the use of layered protocols. This is not unlike how fiat money scales today. For example, at the foundational layer of today's dollar system, USD transactions are made between banks using a system called "Fedwire". Visa operates on top of Fedwire, enabling faster payments for smaller purchases like buying a cup of coffee.

Similarly, the bitcoin blockchain is the foundational layer of the bitcoin ecosystem, and its design specifically optimizes for settlement finality. Using bitcoin to send money is like putting your money into a military-grade tank and sending it off for delivery: it's extremely reliable. In fact, bitcoin is the single most reliable network in the history of computing. It boasts 99.99% uptime since its inception 13 years ago, despite being attacked constantly since then by sophisticated individuals, groups, and nation states. If anyone managed to "break" the bitcoin network, billions of dollars of value (at the time of writing) would be at stake. The fact that nobody has managed to do it so far is a testament to its reliability.

The second layer optimizes for speed and privacy, with some trade-offs related to decentralization. This makes it the ideal "buy a cup of coffee" protocol layer of bitcoin. While the main bitcoin blockchain (layer 1) benefits from cheap, accessible node operation and years of established network effects and is therefore highly decentralized, the Lightning Network (layer 2) is younger (5 years old) and tends toward slightly higher centralization among node operators. However, it's growing exponentially and already has tens of thousands of nodes.

Lightning nodes operate by establishing channels with one another, like little highway systems on which to send value. Importantly, if one node operator (Bob) wants to send value to another (Alice) but doesn't have a channel set up with her, he can still complete the send as long as another node operator (Mallory) exists between them. The transaction will "hop" from Bob to Mallory to Alice. Thanks to degree of separation theory, it's statistically very likely that any given Lightning node will be able to send value to any other through this channel hopping mechanism. This all happens at the speed of light and costs practically nothing.

The term "layer 3" in bitcoin refers to the application layer, where individuals, open source projects, and private companies can build their own applications using the infrastructure of Bitcoin + Lightning. For example, a merchant in Africa can set up an online store that accepts instantaneous bitcoin tips from anyone in the world in as small or large amounts as they want just by scanning a Lightning or Bitcoin QR code. Additionally, extensions to Lightning like LNURL enable companies to use features such as LNURL-AUTH, which allows users to anonymously login to websites just by scanning a Lightning QR code instead of giving out their personal information (name, email, etc.).

Below are some great examples of Layer 3 bitcoin projects and implementations:

The idea that bitcoin will be replaced by an altcoin that is somehow bigger or better is a fallacy. Most altcoin projects market themselves with some combination of the following features:

In each case, they are either mistakenly or intentionally missing the point. We'll address each point below.

The throughput fallacy is the idea that because bitcoin cannot facilitate thousands or millions of transactions per second (TPS) on its Layer 1 chain, it is therefore "too slow" and "can't scale". As discussed above, this puts the cart before the horse. Bitcoin's main chain optimizes security and reliability for final settlement, while its Layer 2 protocols achieve higher transaction throughput than Visa.

The energy fallacy is the idea that there are alternative consensus mechanisms besides proof of work that can accomplish the same security and reliability as bitcoin does today but with far less energy usage. The most popular such alternative that has been proposed is known as "proof of stake". This is a fallacy because proof of stake networks cannot achieve the same combination of security, reliability, and decentralization as bitcoin. Whereas bitcoin's proof of work mechanism requires costly upfront energy expenditure for miners to add blocks to the blockchain, proof of stake protocols afford validating and voting rights based on stake held in the network. At its core, this setup is functionally the same as modern corporations. "Stake" is similar to percentage of shares held in a company, through equity. Proof of stake therefore tends towards centralization, and this undermines its security model.

The dApps fallacy is the idea that decentralized finance and systems in general require the ability to build decentralized applications directly on the base layer of the same blockchain that functions as base money (bitcoin), which is something bitcoin today does not easily facilitate. Proponents of this fallacy think that certain altcoins can achieve the same monetary characteristics of bitcoin but also enable dApps to be built on top. As discussed above, bitcoin's Layer 3 is where applications can most easily and readily be built to enable creativity, entrepreneurship, and collaborative open-source projects on top of bitcoin.

Importantly, the base layer security characteristics of bitcoin cannot be replicated by an altcoin because its organic growth of network effects were established when nobody knew anything about cryptocurrencies yet, so it had time to mature in a relatively non-hostile environment until it grew large enough to sustain itself. If bitcoin were launched today, it would fail instantly because it would immediately be attacked and destroyed before its network effects could be established. It is specifically by virtue of this immaculate conception that bitcoin has become ideal base money for the world.

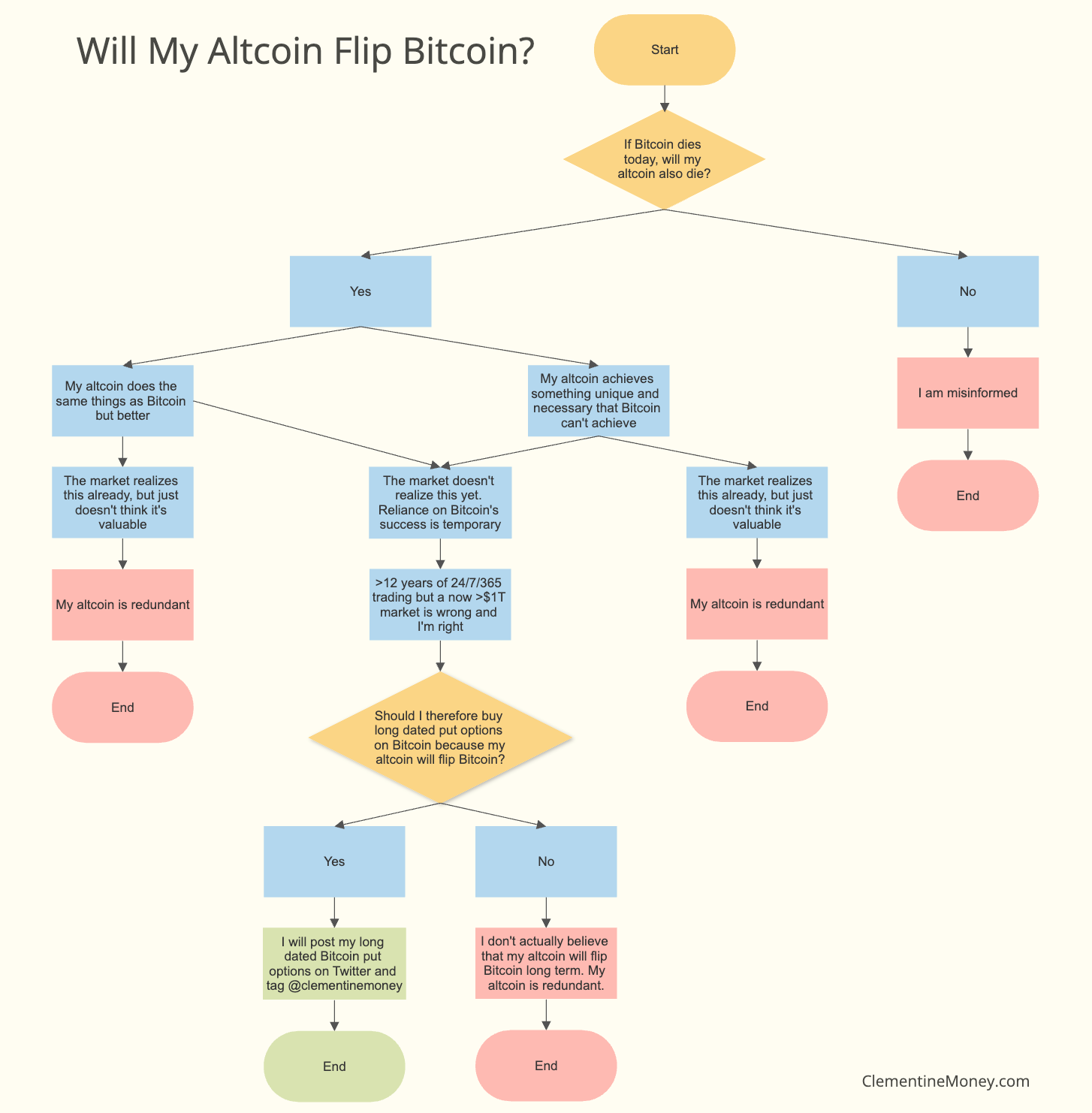

As we have shown throughout this article, Bitcoin has no competitors. However, if you think your altcoin is truly "the next bitcoin", we want to test your conviction!

🇩🇪 German Translation by Simon Satoshi

🇳🇴 Norwegian Translation by Bitcoinplassen

Subscribe for free so you don't miss our next article!

Member discussion