Bitcoin Forks: Explained for Beginners

Enjoy! 🧡

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

"When you come to a fork in the road, take it."

– Yogi Berra

What the hell is a bitcoin fork? Does bitcoin have spoons and knives, too?! And why should I buy magic Internet utensils, anyway? This just sounds like another Ponzi scheme!

Despite the name, a bitcoin "fork" is not for eating food, and it's not going to replace your silverware!

After reading this article, you will understand...

- What is a Fork?

- Hard Forks vs. Soft Forks

- A Brief History of Blockchain Forks

...and more!

High Level Definition

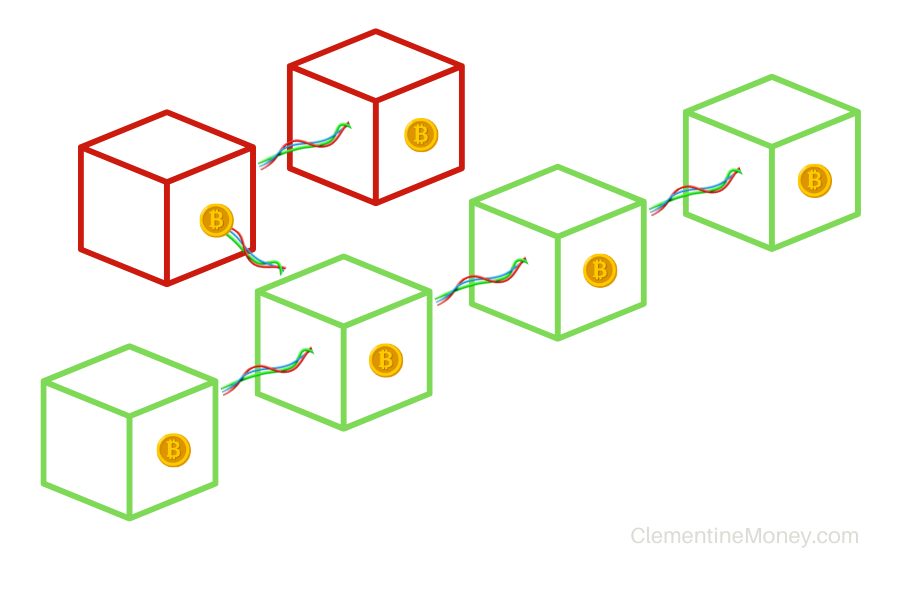

At a high level, a "fork" is when a blockchain splits into two or more chains.

But what exactly does it mean for a blockchain to "split"? Let's look at an analogy.

Bingo Analogy

Imagine a huge room full of 5,000 people all playing a game of Bingo.

Bob and Alice are on opposite sides of the room. Random letters are announced over a sound system and everyone marks the appropriate squares on their Bingo cards. If anyone is lucky enough to spell the word "Bingo" on their card, they can shout "Bingo!" to claim their winnings. If there's a tie, whoever yells "Bingo!" first wins.

But there's a problem: because the room is so big, if Bob and Alice each yell "Bingo!" at the same time, then one half of the room might hear Bob but not Alice, and the other half might hear Alice but not Bob!

Perspective

In the Bingo example above, who really wins? Alice or Bob? Well, it depends.

If you were on Bob's half of the room, you probably heard him yell "Bingo!". To you, Bob is the winner. But if I were on Alice's half of the room, I probably heard her yell "Bingo!". So to me, Alice is the winner!

Our disagreement is a "fork". It's a divergence in our perspectives of the truth.

This is what we mean when we say a blockchain "splits" in two. It doesn't physically break in half like a candy bar; instead, people who previously agreed about the state of the blockchain now disagree.

So, maybe we can be a little more precise with our definition of a "fork"...

More Precise Definition

A fork is a divergence in perspectives about the state of the blockchain.

Recall from our first article What is Bitcoin? –– the bitcoin blockchain is the distributed ledger shared among Bitcoin nodes, organized into chronologically timestamped bundles of transactions known as "blocks".

So a fork in the bitcoin blockchain can occur if some nodes think Block X is the latest block in the blockchain, but other nodes think Block Y is the latest block instead. This is a fork, or a divergence in perspectives about the state of the bitcoin blockchain, and it could occur for several reasons.

Types of Forks

Just as social disagreements can be big or small, blockchain forks can be a big deal or hardly worth mentioning at all.

Let's take a look at the two main types of forks: soft forks and hard forks.

Soft Forks vs. Hard forks

A soft fork is a change that makes the rules narrower. A hard fork is a change that makes the rules wider.

Restaurant Analogy: Soft Fork

Imagine a vegetarian restaurant called The Grassy Leaf. One day, The Grassy Leaf announces it's becoming a vegan restaurant instead. This is a soft fork because the rules got narrower: fewer things are now allowed on the menu than before. Vegetarian customers can still eat at The Grassy Leaf because veganism is a subset of vegetarianism, but now The Grassy Leaf is more optimized specifically for vegans.

Soft Fork Example (Bitcoin History)

One example of a real soft fork that happened in bitcoin is the Segwit upgrade in 2017. This upgrade primarily achieved two things: (1) it allowed more transactions to fit into a single block, and (2) it created a new address type (Bech32).

Both of these changes were backward compatible, meaning any bitcoin nodes using older software or addresses could still operate normally, even with other nodes adopting the new changes. This is why Segwit was a soft fork.

Restaurant Analogy: Hard Fork

Now imagine The Grassy Leaf announces it's expanding the menu to offer steak. This is a hard fork because the rules got wider: more things are now allowed on the menu than before. The Grassy Leaf can no longer be called a "vegetarian restaurant". Vegetarian customers can no longer eat everything on the menu at The Grassy Leaf because steak is not compatible with vegetarianism.

Hard Fork Example (Bitcoin History)

One example of a real hard fork that happened in bitcoin is the Bitcoin Cash hard fork in 2017. Proponents of Bitcoin Cash believed that bitcoin could not scale to support enough transactions for the whole world unless the maximum block size was increased. So, they implemented changes to increase the block size limit, and rejected transactions that did not follow the new ruleset.

Because this change was not backward compatible, it was a hard fork. In effect, this meant a brand new cryptocurrency was born called "Bitcoin Cash" (BCH). Today, more than five years later, the market cap of BCH is just 0.4% of the market cap of the original Bitcoin (BTC), making BCH largely insignificant.

Lessons From History

The most important takeaway from the history of bitcoin's forks is this: bitcoin has always been and today still remains the world's most valuable and widely used cryptocurrency because it is simple, transparent, and decentralized.

Any proposed change that threatens these qualities will likely fail.

Thanks to these qualities, bitcoin is fair, secure, and reliable. If BTC had gone along with the block size limit increase proposed by BCH, then it would have become prohibitively expensive for average people to run a bitcoin node in their own homes. This would spell disaster for bitcoin because it would no longer be decentralized. Without decentralization, bitcoin would become easier to attack and it would inevitably fail.

Instead, bitcoin today scales to support countless transactions every day through the use of off-chain solutions known as "2nd layers" such as the Lightning Network. This is accomplished without compromising the simplicity, transparency, or decentralization of the main bitcoin blockchain.

Member discussion