Why Should You Care About Bitcoin? (Part 1)

As always, some great resources are included at the end of this article if you want to dig even deeper.

Enjoy! 🧡

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

To begin, let's take a step back and think about the money we have today:

- How does it work?

- What gives it value?

- What are its effects on society?

Dirty Magic

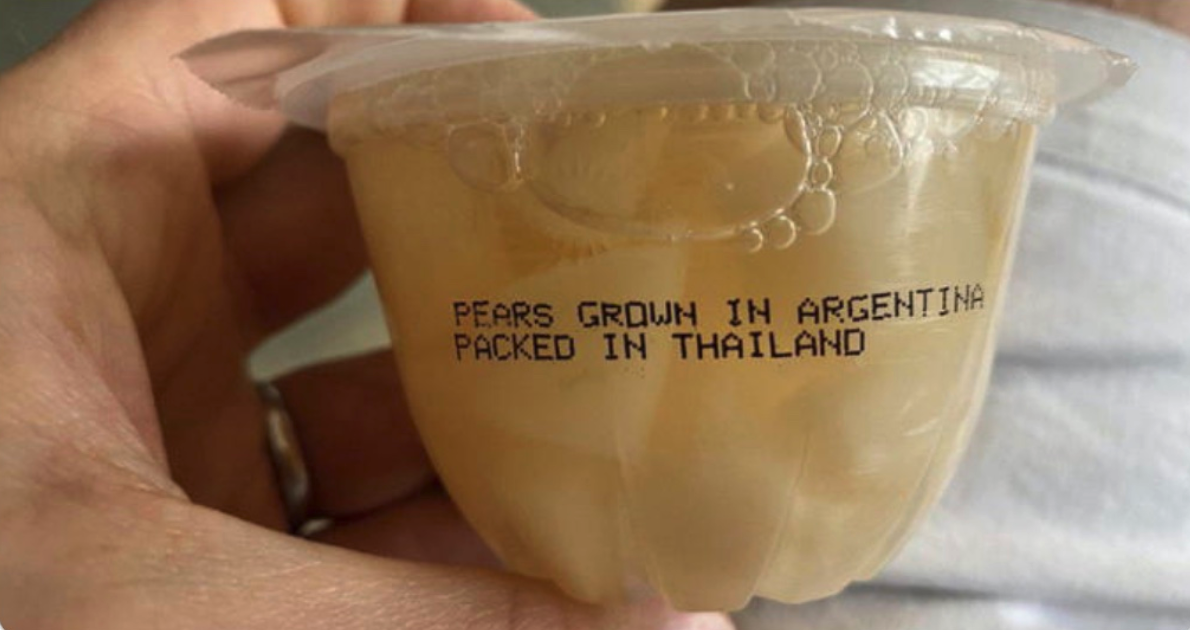

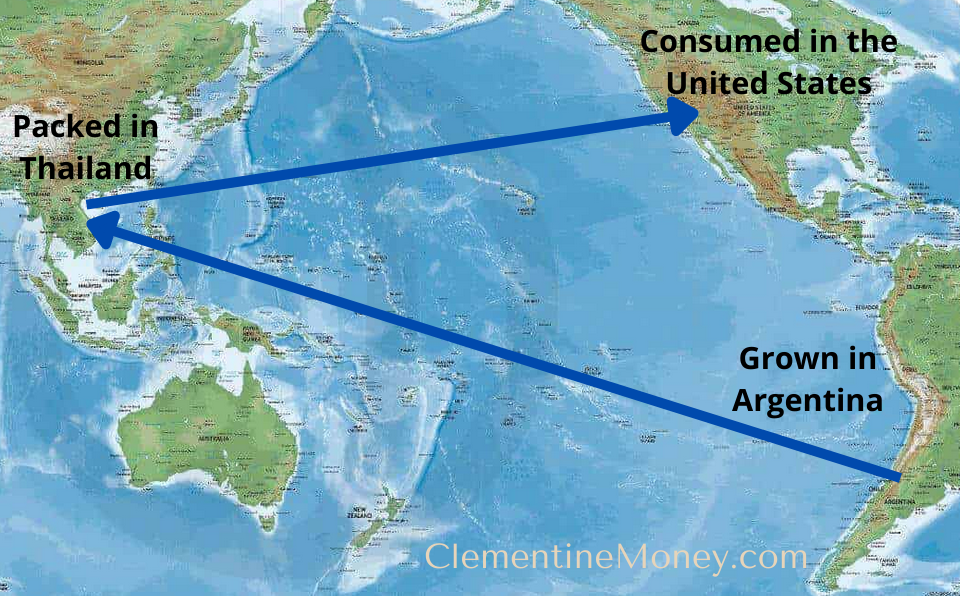

Case Study: Pear Cups

The above image perfectly illustrates modern society's need for immediate consumption. After all, if you want to eat pears, you want them now, damn it! You don't have time to grow and care for your own pear tree.

No, you'll just pick up your phone, open an app, click some buttons, and voila! Pears in a cup, delivered to your doorstep by an Amazon drone the same day.

Magic.

But wait... hold on. What about the waste?

Think about all the...

- fuel used by cargo ships to transport these pears across globe twice,

- trucks running on diesel to ship the product on land,

- and natural gas, crude oil, or coal used to manufacture the plastic.

The 'Pear Cups' case study is useful because it illustrates how all the work, energy and infrastructure involved in getting you what you want when you want it is hidden from you. All the waste––all the dirt––is hidden behind colorful packaging and commercials with happy songs.

Fiat Money is Dirty Magic

Believe it or not, the same thing is true of money itself. Ever wonder why currencies around the world are colorful? That's the packaging. Or why some of the most popular shows on network television are about getting rich? That's the advertising. So what really happens behind the scenes?

Recall from our first article What is Bitcoin?: fiat means by decree. This means the government dictates the currency it prints must be accepted for goods and services. Fiat currencies are not pegged to some scarce commodity such as gold or silver. Such a peg would give credibility to the currency by ensuring it is held accountable to a real world good with unforgeable costliness.

the provable scarcity of an asset or commodity as a function of the difficulty inherent in producing it.

Antiques, time, and gold are all costly, either to produce or due to the improbability of their history, and it is difficult to spoof this costliness.

However, pegging its currency to gold would also hinder the government's ability to print money out of thin air whenever it wants to spend more. Today, if you take any Econ 101 class in the U.S. you will be taught that dollars and treasury bonds are backed by the full faith and credit of the U.S. Government. While technically true, this is very oversimplified. What really backs the dollar is a combination of three things: oil, war, and inflation.

Oil

On average, the United States Department of Defense uses about 12,600,000 US gallons (48,000,000 L) of fuel per day.

Abandoning Gold

In 1971, because of large amounts of debt, the U.S. under Richard Nixon abandoned the gold standard so it could print more money. This meant it would no longer redeem dollars for gold––a departure from the Bretton Woods agreement established in 1944. Countries around the world began to lose faith in the dollar and the global economy fell into a recession.

In 1973, shortly after the U.S. left the gold standard and while it was losing over 10% of its value, things got even worse for the dollar. The Organization of the Petroleum Exporting Countries (OPEC) more than tripled the price of petroleum, leading to sky high oil prices. OPEC could do this because it had a near monopoly on the global supply of oil. With oil being such a crucial resource for energy markets and the dollar losing credibility, the U.S. had to act fast in order to maintain its global economic dominance.

The Petrodollar System

In 1974, the U.S. sent William Simon, the new Treasury Secretary, to Saudi Arabia to negotiate a deal. While this was not publicly described as a "deal with the Devil", revelations later showed that the Devil was in fact in the details:

"The basic framework was strikingly simple. The U.S. would buy oil from Saudi Arabia and provide the kingdom military aid and equipment. In return, the Saudis would plow billions of their petrodollar revenue back into Treasuries and finance America’s spending."

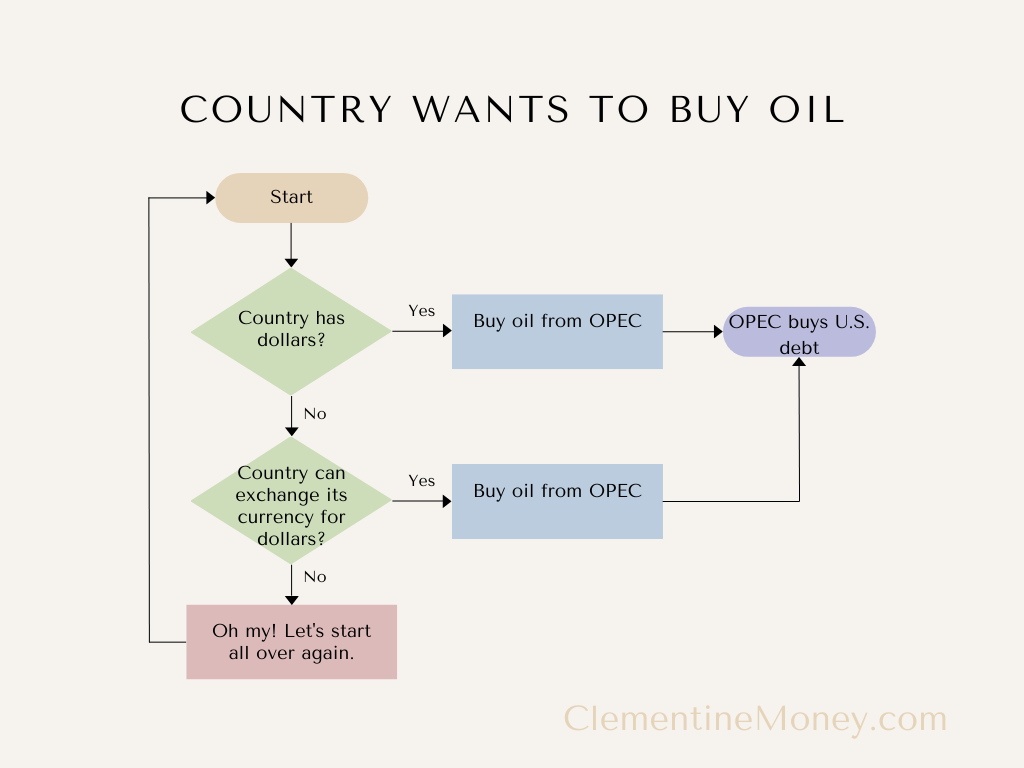

Soon OPEC countries began only selling their oil in U.S. dollars. This enabled the U.S. to keep printing money to buy more oil and Saudi Arabia to use those dollars to continue purchasing U.S. Treasuries in exchange for weapons.

Ever since this pivotal quid pro quo moment, countries that wished to buy oil would first have to convert their currency to dollars so that OPEC, which controlled 80% of the world's oil supply, would sell to them. This created artificial demand for dollars––which became known as The Petrodollar System.

In 2000, Saddam Hussein of Iraq (an OPEC nation) decided to put an end to this system. Saddam denounced the dollar as "the currency of the enemy" and began selling oil for euros (€) instead. Just three years later, he had raked in €26 billion in sales and the world started talking about a new "petroeuro" system. However, these talks didn't last long...

...because in 2003, the United States invaded Iraq.

War

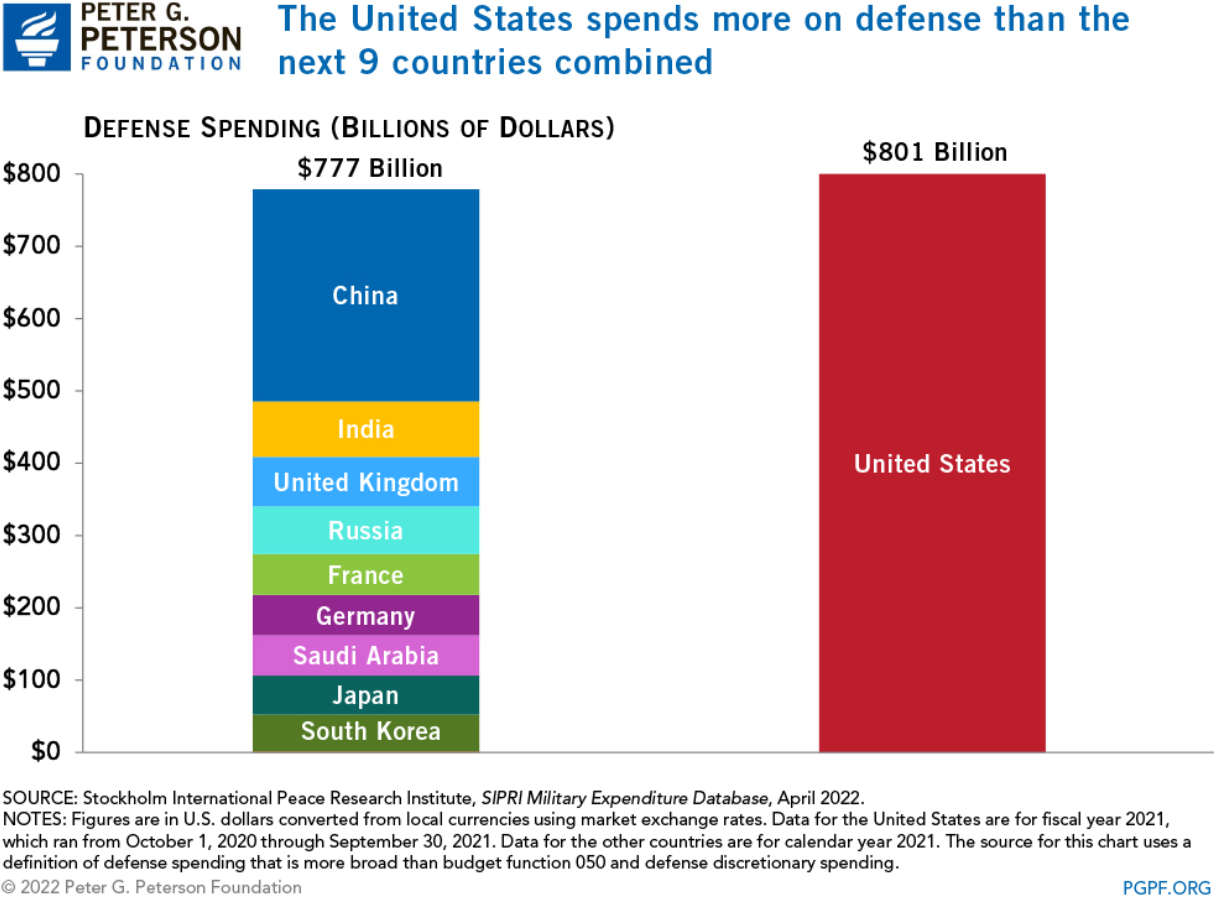

The United States spends more on defense than the next 9 countries combined.

Predictably, Saddam was overthrown within a few short years and Iraq was back to selling oil in dollars. While the impetus for the war is still a topic of heavy debate today, many insiders have since admitted it was a war over oil.

Money is Property

In a similar manner throughout human history, war has enabled theft of all forms of property. This is because owning anything, even one's own life, requires an ability to keep it private. However, property is often difficult to hide––try hiding a house or a plane! Instead, property must often be physically defended.

This is especially true of one of the most fundamental forms of property: money. For example, the U.S. defends its large gold reserves using a heavily armed military installation called Fort Knox.

Unfortunately, because of this natural requirement that property must be defended physically, this has historically led to competition between nation states to acquire more and more physical power. This arms race is a contest to see who can be the biggest and strongest military so that no other country dares to invade and steal property. This eventually led to the development of nuclear weapons and a stalemate known as mutually assured destruction.

the concept that two superpowers are capable of annihilating each other with nuclear weapons, regardless of who attacks first.

Because of this stalemate, physical wars between superpowers are less likely today. However, powerful nations still use war to steal from weaker ones. And when this theft occurs, the long-term effect is to bolster the currency of the winning nation through increased resources, trade, and credit.

In these ways, fiat money is backed by the use of physical violence both to defend property and as a means of stealing the property of weaker nations.

Next, we'll explore how fiat money is backed by another form of theft: inflation.

Inflation

$100 from 100 years ago had the purchasing power of $1,739.86 today.

In Economics, inflation refers to prices increasing over time. Unfortunately, this results in decreasing the value of the currency over time. For example, right now, the annual inflation rate of the U.S. dollar is estimated to be ~8.5%, which means if you can buy something for just $100 today, that same item will probably cost $108.58 next year.

Inflation is theft from our future selves to benefit our present selves.

What Causes Inflation?

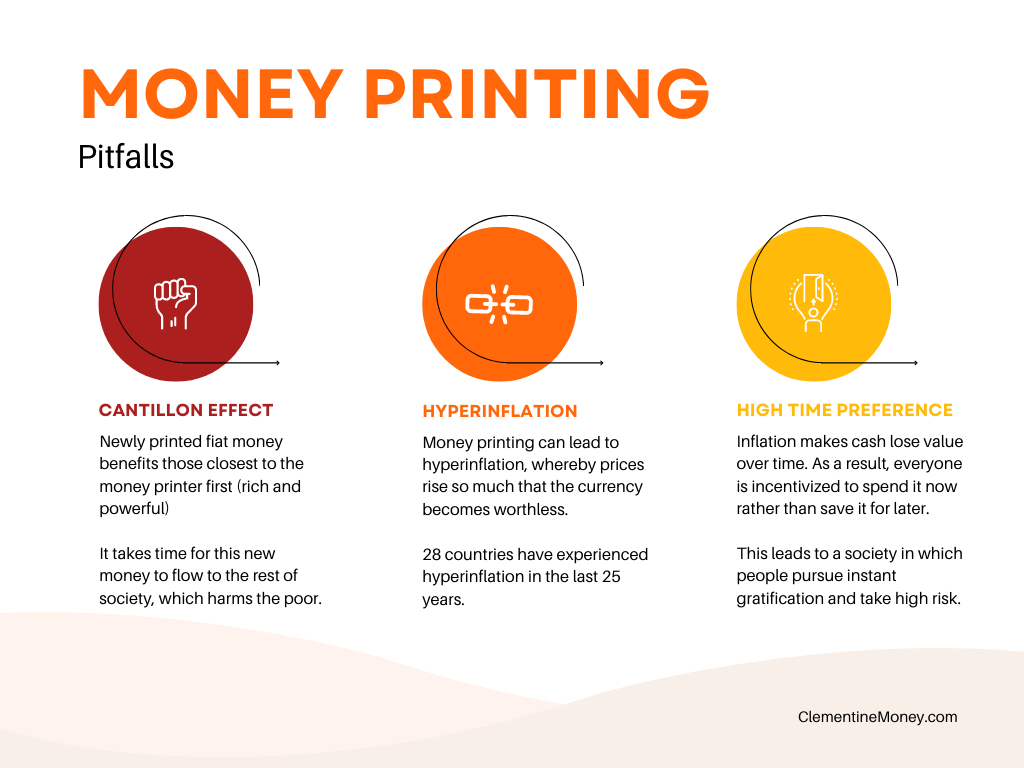

Most often, inflation in fiat money is caused by governments printing money. This puts more money into everyone's pockets (think: stimulus checks) so everyone feels a bit wealthier. But in reality, each dollar is less valuable than before because there are more total dollars in existence.

Example:

- Bob owns $10 out of $100 total in the economy. (Bob owns 10%.)

- The government prints another $100 out of thin air.

- Now Bob only owns $10 out of $200 total in the economy. (Bob owns 5%.)

Bob still owns the same $10, but his wealth was cut in half by the government.

Why Do Governments Print Money?

"The US government has a technology, called a printing press, that allows it to produce as many dollars as it wishes at essentially no cost."

–Ben Bernanke, 14th chair of the Federal Reserve, 2002

While Ben was not being literal in his use of the phrase "printing press", it is true that governments, through the use of central banks, knowingly create inflation regularly by producing money in the form of credit out of thin air because they have short term natural incentives to do so.

a thing that motivates or encourages one to do something.

Fiat money generally operates this way not because of some covert conspiracy, but because over time, in an effort to win political points while maintaining power, governments and those who run them gradually adopt policies that benefit their own self interests. These interests are inherently short term in nature, so those in positions of power typically sacrifice long term fiscal health for short term benefits.

For example, it is far more politically popular to spend money on efforts that show strength and leadership than it is to admit, "sorry, we're actually over budget". But by the same token, it is far less politically popular to raise that money by taxing voters than it is to do so by just printing money and using that to spend more.

Politics of Inflation

The causes and effects of inflation are poorly understood by many. As a result, politicians can confuse voters by blaming inflation on political opponents or by using it as a tool to pass otherwise unfavorable legislation.

For example, just this month, California decided it will send "inflation relief" stimulus checks to its citizens. This, of course, is an oxymoron because giving everyone money causes inflation.

Inflation is a form of theft because it dilutes the share of currency held by each person in the economy. Unfortunately, this especially hurts the poor. The poor tend to save what little they can in cash because they cannot afford other assets. This cash is what loses value first whenever the government prints more currency.

Meanwhile, the wealthy can afford to spend their currency on rare, expensive items such as art, collectibles, and real estate. These items gain value because of inflation. So by converting cash into these scarce assets, the rich profit off of currency inflation.

The rich get richer; the poor get poorer.

Summary

Fiat money is Dirty Magic because it relies upon enormous hidden costs. These include environmental and human costs ranging from the widespread reliance upon fossil fuels to the waste of the military industrial complex; and from the moral abomination that is war to the theft that is inflation, which steals from the poor to benefit the rich and powerful.

As we'll explore in Part 2 of this article, Bitcoin offers a way out of this system and solves many of the pitfalls of fiat money. In many ways, Bitcoin is Clean Magic.

Stay tuned for Part 2!

Share on Twitter

TweetFollow @clementinemoneyAdditional Resources

- [Video] Commodity money vs. Fiat money by Khan Academy

- [Essay] Breaking Down Fiat Money: Utility and Problems by Gemini

- [Essay] The Hidden Costs of the Petrodollar by Alex Gladstein

- [Essay] Banks, QE, and Money-Printing by Lyn Alden

Translations

🇩🇪 German Translation by Simon Satoshi

🍊 Found this valuable?

🎓 Ready to Test Your Knowledge?

Subscribe for free so you don't miss our next article!

Member discussion